Wave Accounting: Fast FactsOur star rating: 4 out of 5Starting price: $0 per month

|

Wave Accounting is an affordable bookkeeping and accounting software service that doesn’t sacrifice features for the sake of pricing. Its expense, income and cash-flow tracking features are perfectly suited to freelancers, solopreneurs and other self-employed individuals who want to keep their accounting software expenses low.

Along with a free-for-life accounting and invoicing plan, Wave offers a paid plan with unlimited receipt scanning, thorough automation and a below-average starting price. Wondering which Wave plan is right for you? In our Wave Accounting review below, we’ll cover Wave’s features, add-ons, pros and cons to help you decide.

Wave Accounting pricing and plans

| Wave Starter | Wave Pro | |

|---|---|---|

| Starting price | $0/mo. | $16/mo. |

| Unlimited invoicing | Yes | Yes |

| Online payment acceptance | Yes, with standard transaction fees | Yes, with optional discounted transaction fees |

| Unlimited bookkeeping records | Yes | Yes |

| Receipt scanning | $11/mo. | Included in base price |

| Automatic bank transaction imports | No | Yes |

| Customer support | No | Yes (email and live chat only) |

| Visit Wave | Visit Wave |

Plan and pricing data up to date as of 2/26/2024.

Until recently, Wave was best-known for its completely free accounting solution. As of 2024, Wave has introduced a second paid plan that gives small businesses the option to scale up with Wave as they grow.

Wave Starter

Price: Free for life

Wave Starter is Wave’s free-for-life accounting plan. At no cost, users can send an unlimited number of invoices to an unlimited number of clients. In contrast, FreshBooks’ cheapest plan starts at $19 and limits you to billing just five clients a month. Xero’s cheapest plan starts at $15 a month and limits you to sending just five invoices a month.

Wave Starter also includes the following key features:

- Optional online payment acceptance (starting at 2.9% + $0.60 per credit card transaction).

- Unlimited estimates and quotes.

- Unlimited customizable invoices with automatic late payment reminders and on-the-go mobile invoicing.

- Unlimited bank connections with unlimited bookkeeping records.

- Crucial accounting reports, including income statements and balance sheets.

Wave Starter doesn’t include free access to unlimited receipt scanning, but free users can add receipt scanning for $11 a month or $96 a year.

Wave Pro

Price: $16 per month or $170 per year.

Wave Pro includes the same features as Wave Starter, with the addition of crucial accounting features and tools that save business owners a lot of time:

- Automatic bank transaction imports, merging and categorization.

- Free unlimited receipt scanning.

- Unlimited users.

- Customer service via live chat and email (no over-the-phone customer support available.)

Optional advisory services

If you want professional help to get your business up and running, you can access bookkeeping experts through Wave for $149 per month. If you want more in-depth support, accountants and payroll coaches are available starting at $379 per month.

Wave Payroll

Wave Payroll integrates seamlessly with Wave Accounting to give you an accurate financial snapshot:

- Self-service payroll costs $20 + $6 per employee per month.

- Full-service payroll costs $40 + $6 per employee per month.

- Both Wave Payroll plans come with a 30-day free trial.

While cheap payroll software providers like Patriot and SurePayroll by Paychex let you choose between their full-service and self-service plans, the Wave Payroll plan you choose is predetermined by the state(s) in which you work.

With Wave, full-service payroll is only available to customers in 14 U.S. states: Arizona, California, Florida, Georgia, Illinois, Indiana, Minnesota, New York, North Carolina, Tennessee, Texas, Virginia, Washington, and Wisconsin.

Businesses in the 36 other U.S. states can only sign up for Wave’s self-service payroll plan.

Wave Accounting key features

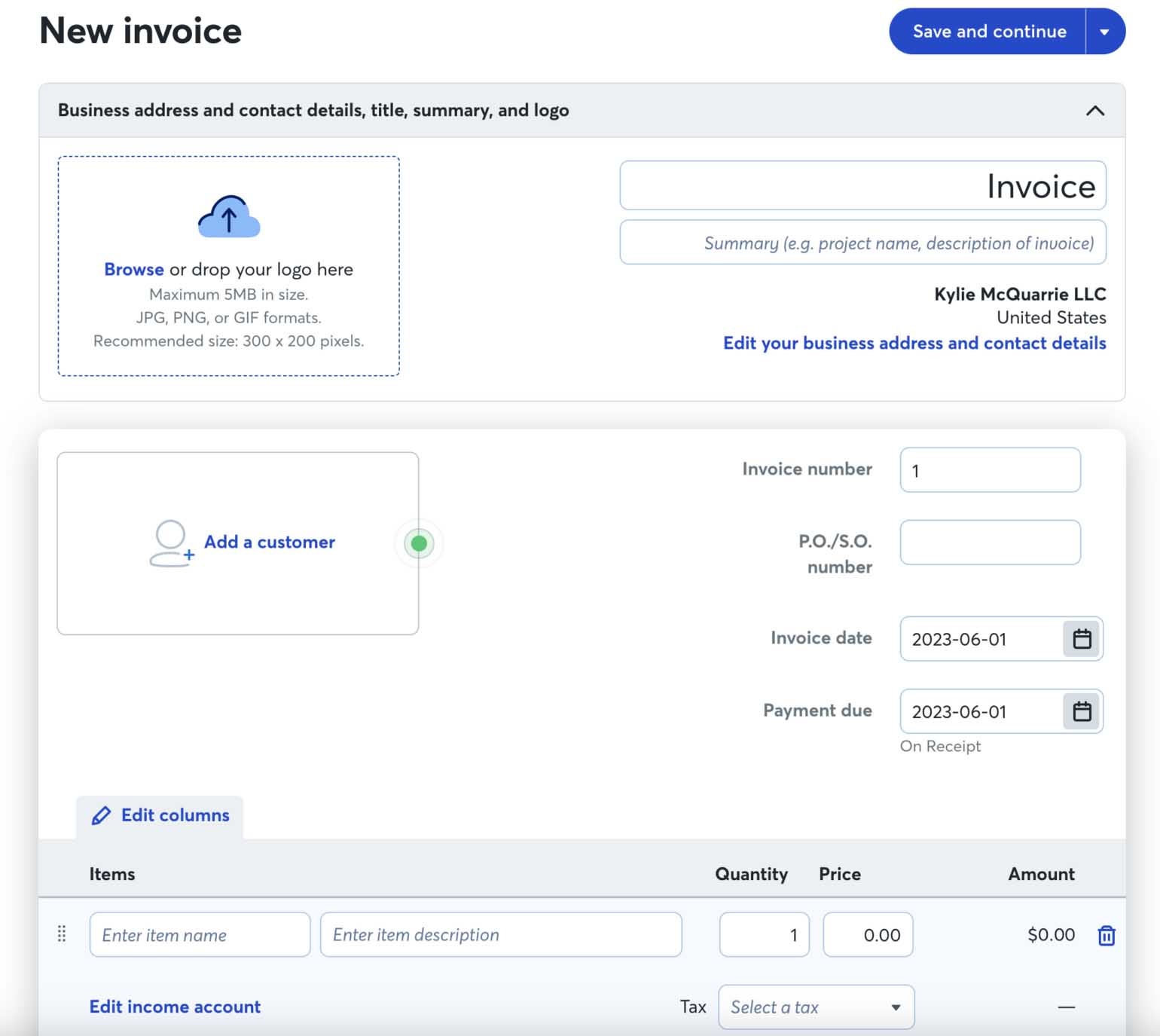

Unlimited customizable invoices

Wave’s invoices are easy to customize with your business’s logo, colors and contact information. If you consistently bill the same clients on a frequent basis, you can set up a recurring invoice template that sends on a preset schedule — an automation some of Wave’s top competitors only include with their mid-tier plans and up.

Wave’s other invoice automations include automatic user notifications when a client views your invoice and pays their bill. You can also schedule automatic payment deadline reminders for clients. Your customers can pay what they owe you directly from the invoice itself, and you can send invoices and accept payments on the go through Wave’s well-reviewed invoice app.

Expense tracking

Users can connect an unlimited number of bank accounts to Wave Accounting software, ensuring every transaction is accounted for and financial snapshots are up to date. While only Wave Pro users can access automated bank transactions and expense categorization, free users can manually categorize expenses by tax category to ensure their data is ready to go by tax time.

Receipt scanning

Users of Wave’s paid and free plans can both access receipt scanning, though only paid users can opt for free receipt scanning. In either case, Wave Accounting’s mobile app lets you capture unlimited receipts and import them in bulk in batches of up to 10 receipts.

Along with mobile receipt capture, you can upload receipts from your computer or forward them from your email.

Unlimited users

If you collaborate with other stakeholders on your business’s finances, Wave’s paid plan is an affordable pick: It lets you add an unlimited number of users to your account, from your accountant to your business partners.

Payroll integration

Wave doesn’t offer any native integrations with third-party apps, though users can rely on Zapier to create their own custom integrations. In fact, the only app Wave Accounting does sync with is Wave Payroll.

While Wave Payroll doesn’t have many unique perks that set it apart from the competition, it’s a good option for business owners who are already familiar with Wave Accounting’s interface. Like Wave Accounting, Wave Payroll is extremely intuitive and user-friendly, so you won’t have to worry about navigating a new software system while dealing with the complexities of making your first official hire.

Wave Accounting pros

At-a-glance pros:

- Completely free-for-life accounting software plan.

- Below-average starting price for Wave’s paid accounting plan.

- User-friendly browser interface and mobile accounting app.

- Unlimited invoicing, expense tracking and billable clients.

- Multi-business management.

- Simple, streamlined account setup.

Completely free-for-life accounting software plan

Wave’s biggest perk is probably its cost, or its lack thereof The only charges you’ll accrue with Wave Accounting’s free plan are typical online payment and transaction fees you pay with any payment processing service. Otherwise, unless you add an optional service like Wave Payroll or Wave Mobile Receipts, Wave Accounting is free to use.

Unlimited invoicing, expense tracking and billable clients

Wave Accounting imposes fewer limits than most of its competitors on everything from users to vendors. For instance, Xero’s cheapest plan limits users to sending 20 invoices a month, while FreshBooks’ cheapest plan limits users to invoicing only five clients a month. With Wave, you can send an unlimited number of invoices to an unlimited number of clients each month.

Plus, Wave Pro lets you add unlimited users to your Wave account.

Simple, streamlined account setup

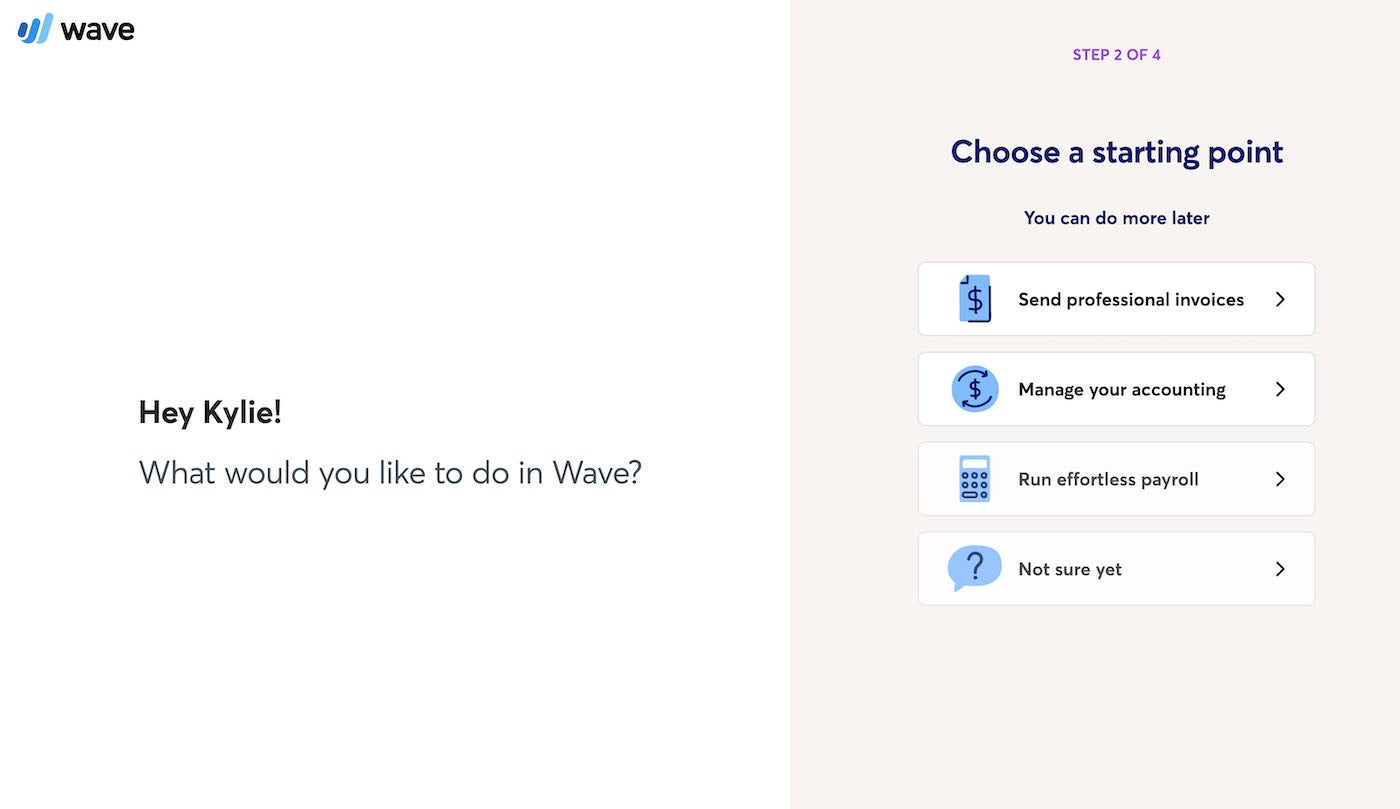

Most accounting software was designed with non-accountant business owners in mind, which means setup should be fairly straightforward. Still, some accounting programs are more user-friendly than others, and Wave Accounting is among the easiest for first-time business owners to configure.

The software setup wizard guides you through four easy setup steps to generate an uncluttered, straightforward dashboard. The interface ensures a low learning curve with friendly graphics, an in-app help center, live chat, user-first design and an accessible app.

Wave Accounting cons

At-a-glance cons:

- No built-in third-party app integrations.

- Fewer accounting features than competitors like QuickBooks.

- Customer service through chat or email only.

- One plan only (limited scalability).

No built-in third-party app integrations

Most popular accounting tools have at least a handful of built-in app integrations that make connecting with third-party services as painless as possible. For instance, Xero and FreshBooks’ native Gusto integrations ensure the accounting and payroll software sync with each other problem-free.

However, the only software Wave Accounting syncs with is Wave’s own payroll service. Otherwise, users must sync Wave with their favorite business management apps through Zapier, a third-party service. Users must create and pay for a separate Zapier account, and Wave’s customer service team can’t help you with any integration-related issues — you’ll have to work with Zapier customer support to get problems resolved instead.

Customer service available only through live chat or email

It’s useful that you can connect to a Wave customer service representative over live chat without navigating away from your accounting dashboard. However, live chat is only available during Wave’s typical business hours, and apart from the chat, your only other support option is email: Wave Accounting doesn’t offer any U.S.-based phone support.

Additionally, free Wave Accounting users don’t have access to customer service. While you can check out articles on Wave’s knowledge base, you won’t be able to connect with a live person who can talk you through any accounting software problems.

Limited scalability

Wave’s introduction of a second plan on top of its free accounting tool makes it a more scalable solution than its previous one-plan-only structure. Still, with just one paid plan, Wave can’t accommodate growing businesses the way multiplan competitors like QuickBooks Online, FreshBooks or Zoho Books can.

For instance, with Wave Accounting, enterprises can’t create custom accounting packages with industry-specific features, and growing companies can’t scale up to heftier accounting plans with more complex tools to support an expanding user base.

Similarly, Wave Payroll has just two plans: full-service payroll and self-service payroll. Users can’t scale up to more comprehensive payroll plans with expansive HR features as their company gains more employees. Instead, the features you get when you first sign up for the plan are the only features you’ll ever get with Wave Payroll.

Top Wave Accounting alternatives

Wave vs. the competition: Feature comparison table

| Vendor | QuickBooks Online | Xero | FreshBooks | Wave Accounting |

|---|---|---|---|---|

| True double-entry accounting | Yes | Yes | Unavailable with cheapest plan | Yes |

| Expense tracking | Yes | With most expensive plan only | Yes | Yes |

| Unlimited invoicing | Yes | Cheapest plan limited to 20/mo. | Yes, for up to five clients/mo. | Yes |

| Number of users | Limited by plan | Unlimited | $11/user/mo. | Unlimited |

| Top payroll integrations | QuickBooks Payroll, Gusto and more | Gusto, SurePayroll by Paychex and more | Gusto and SurePayroll by Paychex | Wave Payroll |

| Starting price | $30/mo. | $15/mo. | $19/mo. | Free |

Plan details are up to date as of 1/23/2024.

QuickBooks Online: Best for comprehensive accounting features

Our star rating: 4.6 out of 5

Starting price: $30 per month

Intuit QuickBooks has been an accounting software provider for decades longer than Wave, Xero or any other accounting company on our list. With that much experience under its belt, it’s no shock that QuickBooks also has more accounting features than most other bookkeeping software companies, starting with the following features:

- Receipt scanning and categorization.

- App-based mileage and expense tracking.

- Cash-flow forecasts.

- Automatic sales and sales tax tracking.

- Customizable estimates (convertible to invoices).

- Contractor management, including Form 1099 distribution and filing.

Higher-tier QuickBooks Online plans include bill tracking, project profitability data, inventory management, employee expense tracking and more.

Put simply, Wave Accounting’s basic bookkeeping features might work nicely for freelancers and small businesses with uncomplicated accounting needs, but for businesses that want to manage accounting in house with the most comprehensive set of tools possible, QuickBooks Online should be selected over Wave Accounting every time.

Learn more by reading our in-depth Wave vs. QuickBooks comparison.

Xero: Best for product-based businesses

Our star rating: 4.4 out of 5

Starting price: $15 per month

Xero’s starting price is half the price of QuickBooks, which makes Xero a more suitable Wave alternative for freelancers on a budget. Wave and Xero also have some crucial, unique features in common, such as unlimited users, unlimited bank connections and optional invoice-based payment acceptance.

In contrast to Wave and its competitors, Xero includes inventory management with every plan, even its cheapest plan. Businesses that sell products can track them more easily — and for a much lower starting cost — with Xero than they can with QuickBooks, FreshBooks or Wave. Unlike other providers, Xero’s plans also come with customizable purchase order software.

Learn more by reading our in-depth Xero vs. Wave comparison.

FreshBooks: Best for invoicing

Our star rating: 4.1 out of 5

Starting price: $19 per month

FreshBooks came to life as an invoice- and billing-specific software program that expanded into a total accounting solution. Its customizable invoices are at least as easy to generate as Wave’s invoices, and FreshBooks offers even more invoice automations than Wave or QuickBooks, such as automatic late-fee additions for overdue invoices.

Along with its standout invoice templates, FreshBooks offers solid features that should appeal to everyone, from contractors to owners of midsize businesses, and everyone in between:

- Sales tax tracking and reports.

- Comprehensive client profiles and account statements.

- Project-based budgeting and billing.

- Built-in time tracking at no additional fee.

Learn more by reading our in-depth FreshBooks vs. Wave comparison.

Should your business use Wave Accounting?

Are you a service-based freelancer in need of a basic, user-friendly way to track your finances without spending money on features you don’t need? If that’s the case, Wave Accounting will likely live up to your expectations. Its invoicing and online payment acceptance features can help you get paid while its reporting and money management tools ensure you stay on track for tax season and future business growth.

Plus, thanks to its integration with the budget-friendly Wave Payroll solution, Wave Accounting can also work well for small businesses with employees. Since the paid version of the software allows for multiple users, it may also appeal to midsize and growing businesses where more than one person keeps an eye on company finances.

But Wave Accounting isn’t right for you if you want complex accounting features, in-depth reports, comprehensive mobile accounting apps, dozens of third-party integrations or phone-based customer service. Instead, consider the following Wave alternatives:

- QuickBooks Online for a full suite of accounting tools and third-party integrations.

- Xero for useful inventory management.

- FreshBooks for affordable invoicing.

How we evaluated Wave Accounting

To review Wave, we set up a free Wave Accounting account that we used to create invoices, record sample transactions and generate financial reports. We also read verified Wave Accounting and Wave app reviews on third-party sites like Gartner, Trustpilot, the App Store, Google Play and more.

While testing the software for ourselves, reading about other users’ experiences and diving into the company’s website, we paid particular attention to Wave’s strengths and weaknesses in the following areas:

- Pricing, especially how Wave’s free plan compared to competitors’ paid plans and how much Wave’s add-on services cost compared to industry norms.

- Accounting features, especially features crucial to freelancers, sole proprietors and small- and midsize-business owners with between one and 50 employees.

- User-friendliness, including Wave’s mobile app functionality, interface functionality, sharing features, ease of setup and ease of integration.

- Customer service, including modes of customer service contact, general customer service reputation and third-party consumer reviews.

To learn more about how we rate and review our software, including how we calculate star ratings for each brand we review, read our software review methodology overview.

Frequently asked questions

Is Wave Accounting safe?

Yes, Wave Accounting is safe and secure to use for bookkeeping. The software is PCI Level-1 certified for processing bank account and credit card information. Wave’s stored bank data relies on 256-bit encryption, and Wave states that its servers are both physically and virtually secured.

How much does Wave charge per transaction?

With Wave’s free plan, users can accept online ACH payments for a standard transaction fee of 1%. Credit card transaction fees for Visa, Mastercard and Discover start at 2.9% + $0.60 per transaction. American Express transactions start at 3.4% + $0.60 per credit card transaction.

For a limited time, new Wave Pro users can accept Visa, Mastercard and Discover payments at a discount.

Does Wave integrate with QuickBooks?

No, Wave Accounting and Wave Payroll do not integrate with QuickBooks Online.

Does Wave Accounting track inventory?

No, Wave Accounting does not include built-in inventory tracking or management.