- Best overall trucking payroll system: Axon Software

- Best accounting integration: QuickBooks Payroll

- Best for small fleets: Gusto

- Most scalable solution: ADP

- Most comprehensive solution: Axis TMS

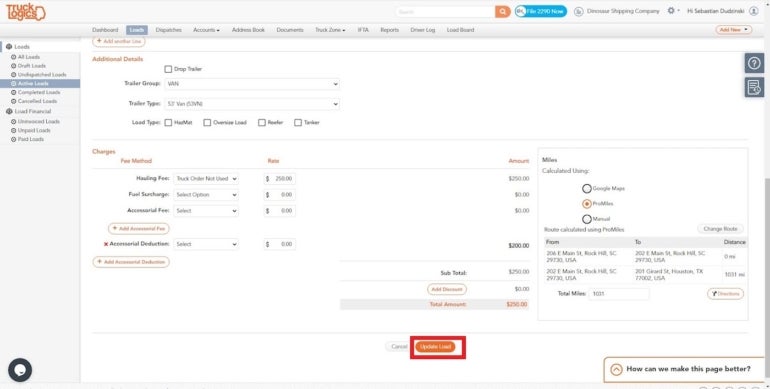

- Most affordable: TruckLogics

Trucking companies have unique payroll needs that often require specialized software to manage the complexities. The best payroll software for trucking companies should add efficiency to managing payroll. Other essential features include tracking driver miles and hours worked, automating payment processing, International Fuel Tax Agreement reporting, integrations with transportation management systems and ensuring compliance with federal and state regulations.

SEE: Payroll Processing Checklist (TechRepublic Premium)

This guide provides an overview of the best payroll software for trucking companies, with information about features, pricing and important factors to consider when choosing the best payroll software for your business.

Best payroll software for trucking companies: Feature comparison table

| Product | Built-in IFTA tracking | Expense tracking | Contractor payment plan | Starting monthly price |

|---|---|---|---|---|

| Axon Software | Yes | Yes | No | Custom |

| QuickBooks | No | Yes | No | $45 + $6/payee |

| Gusto | No | Limited | Yes | $40 + $6/payee |

| ADP | No | Limited | No | Custom |

| Axis TMS | Yes | Yes | No | $99 |

| TruckLogics | Yes | Yes | No | $29.95 |

Top trucking payroll software of the year

Axon Software: Best overall trucking payroll system

Axon Software is a cloud-based transportation management system and payroll software solution designed explicitly for the trucking industry. Its payroll-specific features help trucking companies to manage their payroll and track driver hours.

Unlike ADP and Gusto, Axon software calculates IFTA, fuel taxes, and other trucking-specific taxes and fees. It also provides a secure payroll platform that complies with federal and state regulations.

Axon Software offers customizable reporting and integrates with other trucking-specific systems such as TMS, electronic logging devices and accounting systems.

Pricing

Pricing information is available upon request. Potential buyers can also book a free demo to evaluate product features.

Key features

- Compiles government forms and reports, including W2, W3, 1099, T4 and T4As.

- Enables truck drivers to share their GPS location and communicate with in-house administrators via phone or text message.

- Manages driver, owner, operator and carrier calculations for wages and expenses.

- Provides an end-to-end report on equipment revenue, cost-per-mile and miles-per-gallon.

Pros

- Real-time truck location tracking.

- All-in-one solution for trucking business operations, including dispatching, accounting, payroll and maintenance.

- Tracks IFTA and fuel tax.

- Automatically compile government forms and documents, such as W2s, W3s, 1099s, T4As and more, with a single click.

Cons

- Steep learning curve.

- Lacks transparent pricing.

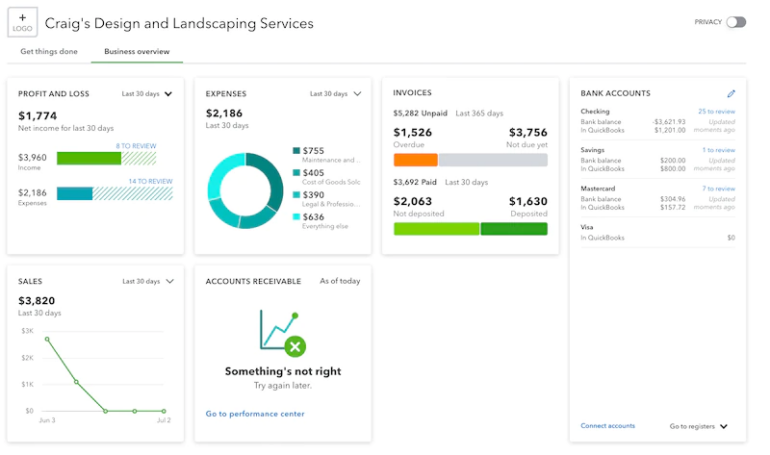

QuickBooks Payroll: Best accounting integration

QuickBooks Online Payroll is one of the most popular and widely used payroll software solutions for trucking companies. Most QuickBooks Payroll users already use QuickBooks Online, a comprehensive accounting software program that manages finances, tracks income and expenses, creates invoices, and generates financial reports. QuickBooks also offers integrations specifically tailored to the trucking industry for fleet management, dispatch and driver tracking.

Additionally, QuickBooks Online integrates with tools such as HyperTrack and RAMA Logistics Software, allowing users to easily monitor fleets, track mileage, track load status, dispatch trucks and freight, and pay drivers and carriers. Integrating these tools makes it easy for users to stay on top of their company’s transportation operations and ensure timely payments.

Using QuickBooks Payroll in conjunction with trucking-specific integrations, trucking companies can easily import truckers’ hours worked, generate paychecks, submit payroll taxes and calculate workers’ compensation premiums.

For more information, see our QuickBooks Online Payroll review.

Pricing

QuickBooks offers multiple pricing plans — and frequent discounts — so trucking businesses can choose the features they need while staying within their budget. QuickBooks Payroll also comes with either a 30-day free trial for 50% off the monthly base price for three months:

- QuickBooks Payroll Core: $45/mo. + $6/employee.

- QuickBooks Payroll Premium: $80/mo. + $8/employee.

- QuickBooks Payroll Elite: $125/mo. + $10/employee.

Key features

- Automatic tax administration, including federal, state and local payroll tax filing.

- Built-in benefits administration and optional insurance and retirement plan add-ons.

- Create and e-file unlimited 1099-MISC and 1099-NEC forms.

- 1099 contractor management.

- Customizable payroll reports such as history, bank transactions, tax payments and paid time off.

Pros

- Same-day or next-day direct deposit available.

- Tax penalty protection.

- TMS integration.

- Time tracking capability.

- Available in all 50 states.

- 401k plans

Cons

- No IFTA tracking.

- QuickBooks Payroll only syncs with QuickBooks Online for accounting.

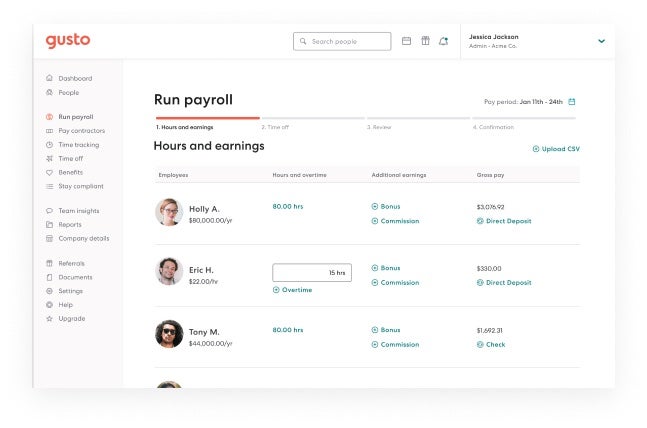

Gusto: Best for small fleets

Gusto is one of our best payroll processing solutions for small businesses, which includes many trucking companies. The platform provides businesses with the resources they need to manage payroll, benefits, HR and compliance for driver staff, contractors and other employees. It is a cloud-based service that can be accessed from anywhere, making it ideal for employers managing remote teams.

Gusto also offers several other useful features for trucking companies, including an automatic time-tracking feature that records hours worked by drivers and contractors across different projects or sites. Gusto integrates with Timeero — a time, mileage and GPS tracking software solution — but compared to QuickBooks, Gusto lacks key TMS or fleet management integrations. This may limit Gusto’s utility for larger trucking companies.

To learn more about Gusto, read our comprehensive Gusto payroll review.

Pricing

Gusto offers three pricing plans, plus a contractor-only payment option:

- Gusto Simple: $40 per month plus $6 per employee per month.

- Gusto Plus: $80 per month plus $12 per employee per month.

- Premium: Quotes available upon request.

- Contractor only: $35 per month plus $6 per contractor. The base price is waived for the first 6 months.

Key features

- Automatic federal, state and local tax filing.

- Integrates with accounting, time tracking and expense management tools.

- Allows users to generate and download reports for payroll history, bank transactions, contractor payments, paid time off and tax payments.

- Calculates and withdraws pre-tax deductions for benefits and post-tax deductions such as garnishments.

- View and export payroll data.

Pros

- Next-day direct deposit with some plans.

- Supports multiple pay schedules.

- Unlimited payroll runs.

- Works for hourly and salaried employees.

Cons

- Health benefits not available in all states.

- Simple plan has limited HR features.

- Lacks TMS integrations.

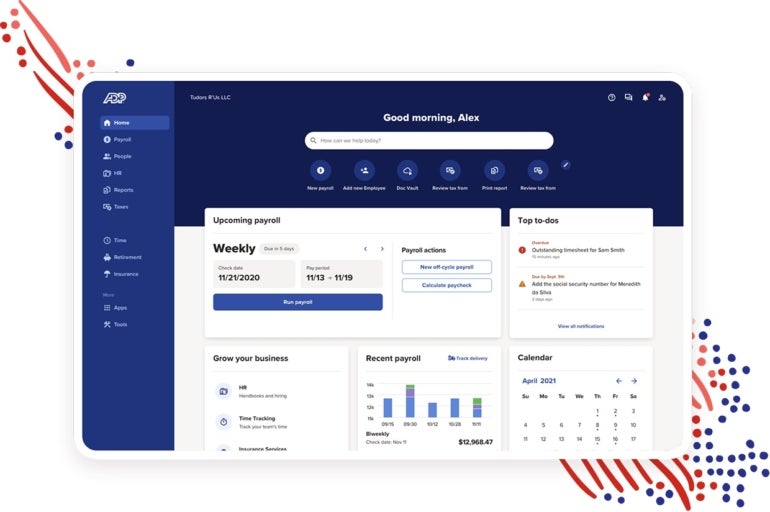

ADP: Most scalable solution

ADP, otherwise known as Automatic Data Processing, is a payroll software provider that offers businesses of all sizes and industries — including trucking companies — a suite of services that can help with payroll and other HR management tasks.

The company’s payroll platform includes tax filing and direct deposit options, as well as integrations with TMS solutions such as TripLog. The platform also includes support for managing driver and non-driver employee designation benefits, like retirement accounts or health care contributions. It’s customizable, so users can tailor the features and modules to specific business needs.

ADP offers a variety of products to suit multiple business sizes across multiple industries. The best ADP solutions for trucking companies include ADP Workforce Now, an HCM solution for midsize and large businesses, and ADP RUN, a payroll/HR software solution.

Find out more about which ADP payroll product could be right for you by reading our ADP Workforce Now and RUN Powered by ADP reviews.

Pricing

ADP offers four payroll plans. Specific information about each pricing plan is available upon request.

Key features

- Payroll debit cards and multi-state payroll in all plan levels.

- Tax reporting with W-2s and 1099.

- Labor law poster compliance.

- Conducts single-county background checks, including SSN validation, criminal history and search for the current county of residence.

- Time and attendance management.

- Supports over 100 third-party integrations.

Pros

- 24/7 support.

- Same-day direct deposit is available.

- Feature-rich platform.

- Comprehensive reporting and analytics.

- Automated processes for payroll, benefits and tax filing.

Cons

- Lacks IFTA reporting.

- Lacks transparent pricing.

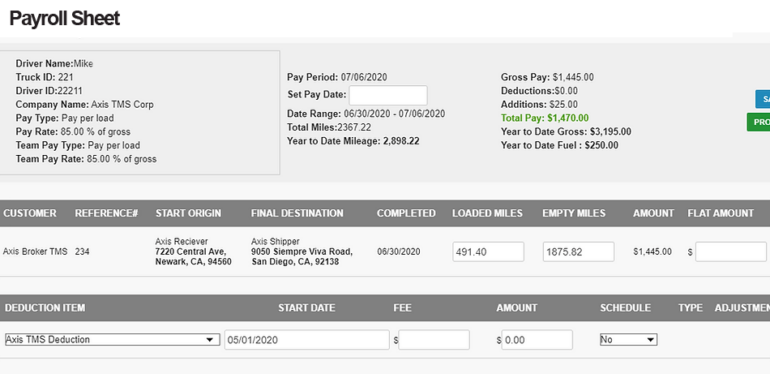

Axis TMS: Most comprehensive solution

Axis TMS is a cloud-based trucking management software that provides carriers and fleets with an end-to-end solution for managing their business. This platform enables users to easily track, manage and improve the efficiency of their trucking business operations.

Axis TMS provides users with a wide range of features to streamline processes related to driver payroll, customer invoicing, dispatch, route optimization and fuel tax reporting. Trucking company users can work with both software and hardware solutions from Axis TMS; hardware solutions include tablets for drivers, dash cameras, asset trackers and sensors.

Pricing

Axis TMS pricing is categorized into two groups: Monthly payment plans for customers with less than 150 trucks and enterprise plans for customers with over 150 trucks. Driver payroll is included in all plans.

Plans for small, midsize and large trucking businesses start at $99 per month. Enterprise-level pricing is available by request.

Key features

- Pro app allows users to manage payroll, keep track of payment status, generate and distribute invoices, and send real-time notifications to drivers.

- Truck location monitoring along the defined route, with ETA calculator, arrival status and trailer availability status included.

- IFTA mileage and fuel sync.

- End-to-end document scanning.

- Automatic invoice generation.

- Weekly, bi-weekly or monthly payroll runs for drivers.

Pros

- Provides niche features that are relevant to trucking companies.

- Helpful support team.

- Offers various payment options, including pay-per-load, pay-per-mile and pay-per-hour.

Cons

- The user interface could be improved.

- Users have reported that the solution is infrequently glitchy.

- Limited transparent pricing online.

TruckLogics: Most affordable

TruckLogics is an online trucking software platform that helps trucking companies manage their business operations. It provides tools to manage customer relationships, route optimization, driver management, dispatching, fuel tracking, invoicing and fleet tracking.

TruckLogics also offers features for compliance, analytics and reporting. Its integrated payroll module allows you to manage driver payroll, calculate wages and track driver hours. It also includes tools for IFTA and document management.

Pricing

TruckLogics offers a 15-day free trial. The company offers various plans for different business sizes that are payable monthly or annually:

- Pricing for small fleets (between three and seven trucks) starts at $29.95/mo.

- Pricing for midsize fleets (between eight and 14 trucks) starts at $49.95/mo.

- Pricing for large fleets (15 or more trucks) starts at $79.95/mo.

Key features

- Manages income and expense transactions.

- Manages received payments.

- Integrates with Motive, QuickBooks, EFS, DAT, Google Maps and Promiles.

- Provides year-end tax reports.

- Driver payments reporting.

Pros

- Users can track freight using the mobile app.

- Invoice generation.

- Generate IFTA tax reports.

- Intuitive user interface.

- Affordable pricing.

Cons

- Users reported slow page load time.

- Reporting features could be improved.

What to look for in trucking payroll software

Trucking payroll software is an invaluable tool for any trucking business. It can simplify payroll management, save time and money, and improve accuracy and compliance with transportation-specific tax regulations.

SEE: Travel and business expense policy (TechRepublic Premium)

When selecting trucking payroll software, it is important to consider the following features:

Streamlined payroll processing

Look for software that automates payroll processing, from calculating taxes and deductions to making payments to employees. This will help streamline your payroll process, eliminating the need to enter information manually and ensuring accuracy.

Tax compliance

Tax compliance is paramount for trucking businesses. Make sure the software you select can accurately calculate federal, state, and local taxes and deductions. The software should also be able to generate all necessary forms, including W-2s and 1099s.

Reporting features

Consider software that provides comprehensive reporting capabilities. This will make tracking employee hours, wages and taxes easier. It should also provide the ability to generate reports, such as employee payroll summaries.

Integration capabilities

It’s ideal to find a trucking payroll solution that can easily integrate with other systems used in the trucking industry, such as transportation management systems. This will enable you to streamline data entry and reduce manual processes. It will also make it easier to manage payroll information, run reports and make payments.

IFTA and fuel tax

Trucking companies must comply with various interstate travel regulations, which require proper reporting of fuel taxes and IFTA filings. Look for payroll software that simplifies this process by automatically collecting and processing relevant mileage information, allowing you to generate compliant IFTA and fuel tax documents quickly. Some trucking payroll solutions may offer built-in document management tools, which allow you to store these documents securely and retrieve them easily when needed.

User experience

Make sure the payroll software you select offers an intuitive user interface that is easy to navigate. This will help ensure employees can quickly complete payroll tasks without confusion or frustration. It’s ideal if the software provides guidance or tutorials to help users understand how to use the system correctly.

Support

It is important to choose a payroll provider that offers customer support options like phone, email or live chat. This will give you someone to turn to if you encounter issues or questions while using the software.

Selecting the right payroll solution for your trucking business

When selecting payroll software for your trucking business, look for easy setup, automated payroll processing, compliance with federal and state regulations, reporting capabilities and integration with other accounting software. More importantly, consider the strengths of your internal operators and drivers alike.

The right payroll solution can make running your business much easier and more efficient, but it’s crucial to consider what you really need from the software and how much it will cost to get those features and services.

Read next: The Best Payroll Software for Your Small Business (TechRepublic)